Contractors Insurance Needs

Protecting businesses from various risks is crucial. Comprehensive coverage includes liability, property, and workers' compensation, safeguarding operations.

Research topics

As a contractor, you're no stranger to risk. From on-site accidents to unforeseen project delays, there are countless challenges that can arise. That’s where the importance of contractors insurance comes into play. Knowing what types of coverage you need can make all the difference, not only in protecting your employees and assets but also in ensuring your business's longevity.

Why Do Contractors Need Insurance?

Contractors face a unique set of risks. Injuries on the job site, damage to client property, and legal liabilities are just a few examples. Without proper insurance, one mishap could jeopardize your business's financial stability. Understanding your specific insurance needs is crucial for safeguarding your livelihood.

The Core Insurance Types for Contractors

There are several essential types of insurance every contractor should consider. Let's break them down:

General Liability Insurance protects you from claims involving bodily injury or property damage that occur during your work. It covers legal fees and payouts, providing a safety net for your business.

If an employee gets injured while working, Workers Compensation Insurance steps in to cover medical expenses and lost wages. It's not just a good idea; in many states, it’s a legal requirement!

This type of insurance is crucial for contractors who provide consultation services. Professional Liability Insurance protects against claims of negligence or errors in your professional advice or services, keeping your reputation intact.

If you use vehicles for your business, Commercial Auto Insurance is a must. This coverage protects your vehicles and drivers while on the job, ensuring you’re covered in the event of an accident.

A Business Owners Policy combines multiple coverage types, including property insurance and liability insurance, into one convenient package. This can be a cost-effective way for small contractors to obtain comprehensive coverage.

Additional Coverage Options for Contractors

Beyond the basics, there are additional coverages that many contractors might overlook but are invaluable for a smooth operation.

Surety Bonds ensure that contractors fulfill their obligations to the project owner. They protect the client if a contractor fails to deliver what was promised, making them a crucial aspect of contractor credibility.

Holding Builders Risk Insurance is vital for anyone engaged in new construction or major renovation projects. It covers buildings and materials until the job is finished, safeguarding your investment against theft, vandalism, or damages.

If your business relies on machinery, Equipment Breakdown Coverage can provide protection against mechanical failures that could disrupt your operations. Repair costs can pile up quickly, making this coverage invaluable.

In today's digital age, Cyber Liability Insurance is becoming increasingly necessary, especially for contracting businesses that handle client data. It protects you against data breaches and cyberattacks, ensuring your company’s resilience against online threats.

Lastly, both Umbrella Insurance and Excess Liability Insurance extend the limits of your liability coverage. These are critical, especially for contractors dealing with high-value projects or those who want additional peace of mind.

Understanding Contractors Insurance Costs

Now, you might wonder, “What would all of this insurance cost me?" Understanding Contractors Insurance Cost depends on various factors, including the type of work you do, the value of your equipment, and the size of your business. Generally, contractors can expect a range of pricing options, so it's wise to shop around and compare different providers.

Consider getting quotes from reputable insurers like Progressive Commercial and The Hartford, which offer various coverage options tailored specifically for contractors.

Final Thoughts

As a contractor, investing in the right insurance is not just about compliance; it's about ensuring your business thrives despite potential pitfalls. By considering the various types of coverage available, including the crucial Excess Liability Insurance, you can build a strong safety net for your business and proceed with confidence in every project.

In conclusion, understanding your contractors insurance needs is essential for any contractor looking to protect their business, employees, and clients. Take the time to evaluate your risks and ensure you have the necessary coverage to navigate the often turbulent waters of construction risks.

Posts Relacionados

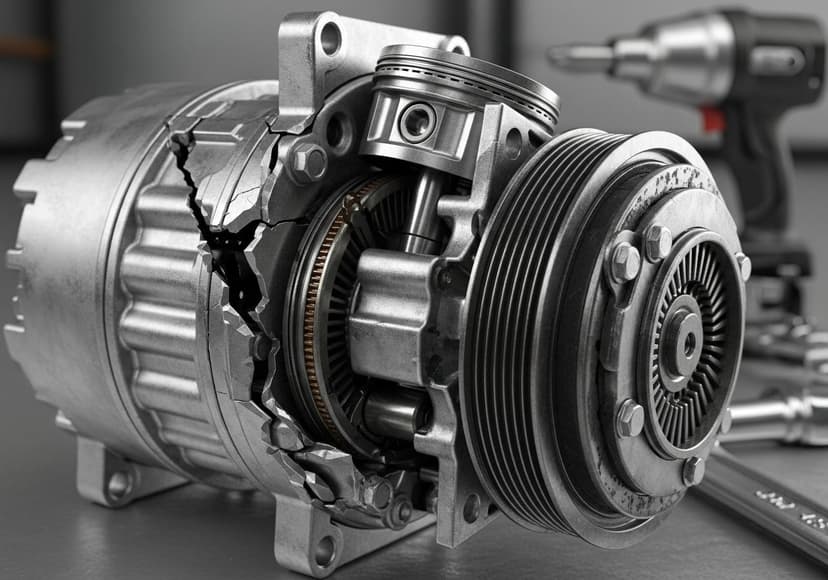

Ac Compressor Common Problems

Common issues involve refrigerant leaks, clutch failure, and internal damage impacting cooling efficiency and leading to repairs.

Ac Drain Cleaning Diy Guide

Regularly clean your AC drain to prevent clogs, maintain efficiency, and avoid potential water damage.

Ac Efficiency Maximizing Performance

Improve air conditioning efficiency by optimizing components. Achieving peak performance ensures reduced energy consumption.