Guide To Senior Insurance Riders

Explore vital insurance riders designed for seniors, enhancing coverage and offering specialized protection, ensuring peace of mind.

Research topics

Navigating the world of insurance can be a daunting task, especially for seniors. Thankfully, Senior Insurance Riders can help enhance your policy and tailor it to your unique needs!

What Are Senior Insurance Riders?

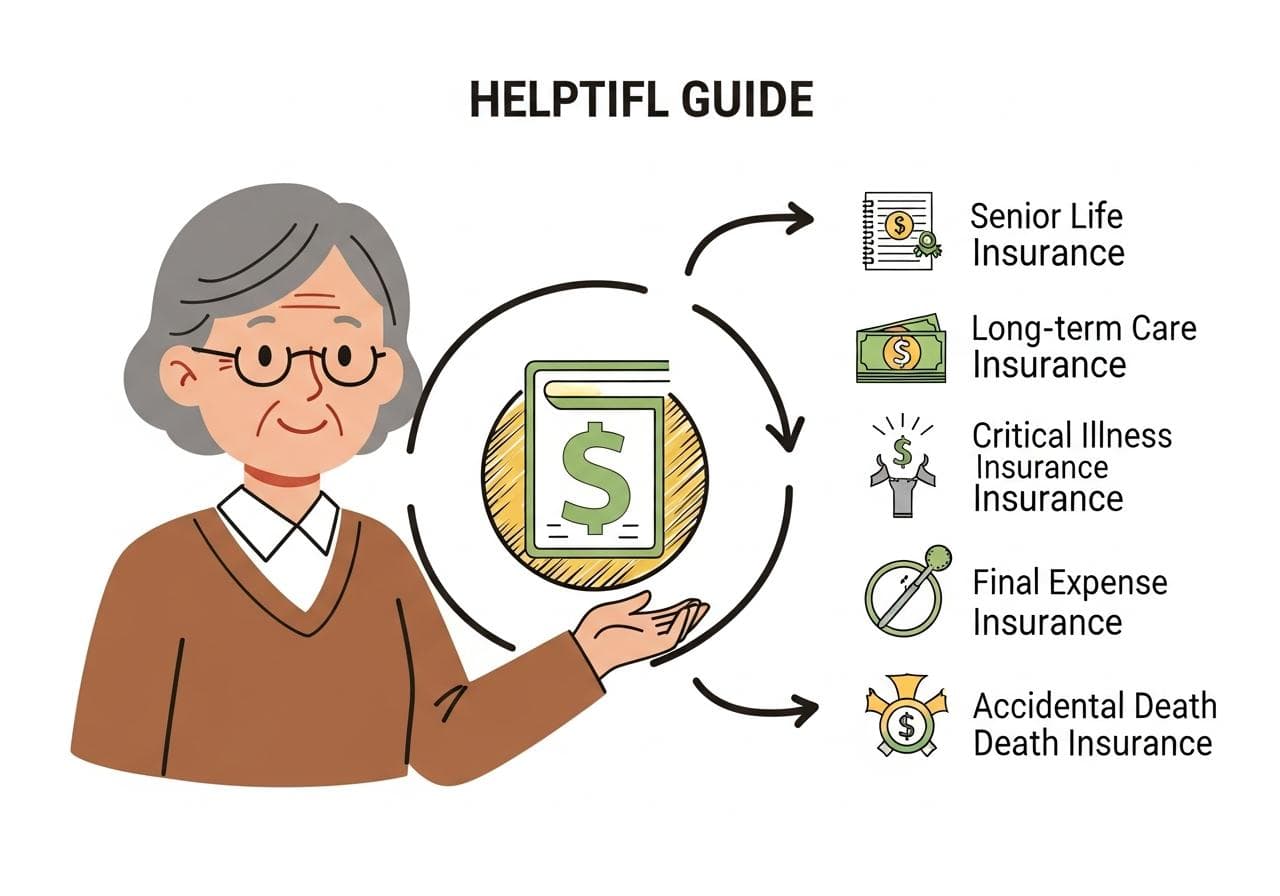

Senior Insurance Riders are additional provisions or options that can be added to a life insurance policy to provide extra benefits or coverages. These riders can cater specifically to the needs of older adults, giving them more flexibility with their Senior Life Insurance plans. If you are curious about how insurance riders work, you can check out this resource for more detailed information.

Types of Insurance Riders for Seniors

There are several types of Senior Insurance Riders tailored to the unique medical and financial needs of seniors. Let’s take a closer look at some of the most relevant options:

The Long-term Care Insurance rider is designed to help cover the costs of long-term care services, such as in-home care or care facilities. This rider can ease the financial burden associated with these expenses, making it an essential option for many seniors.

This rider provides a lump sum payout if you are diagnosed with a covered critical illness, such as cancer or heart disease. It offers peace of mind, knowing that you will have financial support during such challenging times. It’s a must-have if you want extra reassurance.

Final Expense Insurance Rider

Final Expense Insurance is another valuable rider for seniors. It ensures that your loved ones are not burdened with the costs of your funeral and other expenses after you pass away. This rider provides the necessary funds, allowing your family to focus on grieving rather than finances.

Accidental Death Insurance Rider

Accidental Death Insurance is a rider that offers additional benefits if the insured passes away due to an accident. This can provide your beneficiaries with extra funds during a difficult time, ensuring that they are financially secure.

Understanding Medicare Supplement Insurance and Medigap Plans

Many seniors turn to Medicare Supplement Insurance (or Medigap Plans) to fill the coverage gaps left by traditional Medicare. Choosing the right Medigap plan is crucial since these plans can cover out-of-pocket costs associated with doctor visits, hospital stays, and other essential healthcare services. It's worth exploring these options if you're navigating insurance post-retirement.

Insurance Riders for Seniors: Why They Matter

Insurance Riders are essential tools to enhance your basic insurance policy. They provide tailored benefits that cater to the specific needs of seniors, allowing you to customize your coverage. Choosing the right riders can significantly impact your financial and health security in your later years.

Finding the Right Insurance for Seniors

Choosing the right Insurance for Seniors involves understanding what you need based on your health status, financial situation, and family dynamics. It's essential to read through the options available and consult with a qualified insurance agent who understands the nuances of senior health insurance and can assist you in navigating the options effectively.

Once you have decided on a policy, it’s equally important to review the specific riders available with those policies. It may be beneficial to reach out to companies offering comprehensive plans and get quotes based on your requirements.

Your health and financial security deserve careful consideration. By understanding Senior Insurance Riders and the benefits they offer, you can make informed decisions for your future. Make sure to explore the options available and consider how adding riders to your policy can enhance your insurance coverage.

For more insights on customizing life insurance with riders, visit this page. Remember, planning for your future today can yield a secure tomorrow!

Posts Relacionados

55 Plus Senior Communities The Pros And Cons

These communities offer active lifestyles but may have restrictions and higher costs for those seeking senior living.

55 Plus Senior Living Communities

These communities provide tailored housing, amenities, and social opportunities for individuals aged fifty-five and older.

Active Adult Community Guide

Discover fulfilling retirement living. Explore community options, amenities, and lifestyle choices designed for active adults seeking connection and well-being.