Navigating Medicare And Medicaid Benefits

Planning senior healthcare requires understanding these complex federal programs. Learn the requirements and options.

Research topics

Understanding Medicare and Medicaid can be a bit overwhelming, but with the right information, you can effectively navigate the complexities of senior healthcare planning. Both programs serve essential roles, ensuring that seniors have access to necessary medical services, but they do have their differences. Let's break down how you can make the most of these benefits, especially when it comes to Home Healthcare Services.

Understanding Medicare Cost

Medicare typically consists of four parts: Part A covers hospital stays, Part B covers medical services, Part C is a combo of A and B from private insurers, and Part D is for prescription drugs. If you're wondering about Medicare Cost, it’s important to know that while many beneficiaries qualify for premium-free Part A, others may have to pay premiums for Part B and D. It’s worth regularly reviewing your options to ensure you're not overpaying.

Medicaid Eligibility: What You Need to Know

On the other side of the healthcare spectrum is Medicaid, which provides assistance based on financial need. Knowing Medicaid Eligibility is crucial, especially if you or your loved ones are considering long-term care. Income limits vary by state, and many states also have asset limits. If you’re unsure, your best bet is to consult with a local Medicaid office or an experienced elder law attorney.

Long-term Care Insurance

While Medicare and Medicaid can cover specific healthcare costs, they often fall short on long-term care needs. This is where long-term care insurance can come in handy, covering expenses for services like assisted living facilities and nursing home care that Medicare does not. Investing in this insurance may provide you peace of mind, knowing you will have financial support when you need it the most.

Exploring Assisted Living Facilities & Nursing Home Care

If you begin to require more help, you might consider assisted living facilities or nursing home care as viable options. While Medicare offers limited coverage for these services, Medicaid can help if you meet their eligibility requirements. Assess your loved one's needs to determine the best environment, and be sure to explore all financial options available.

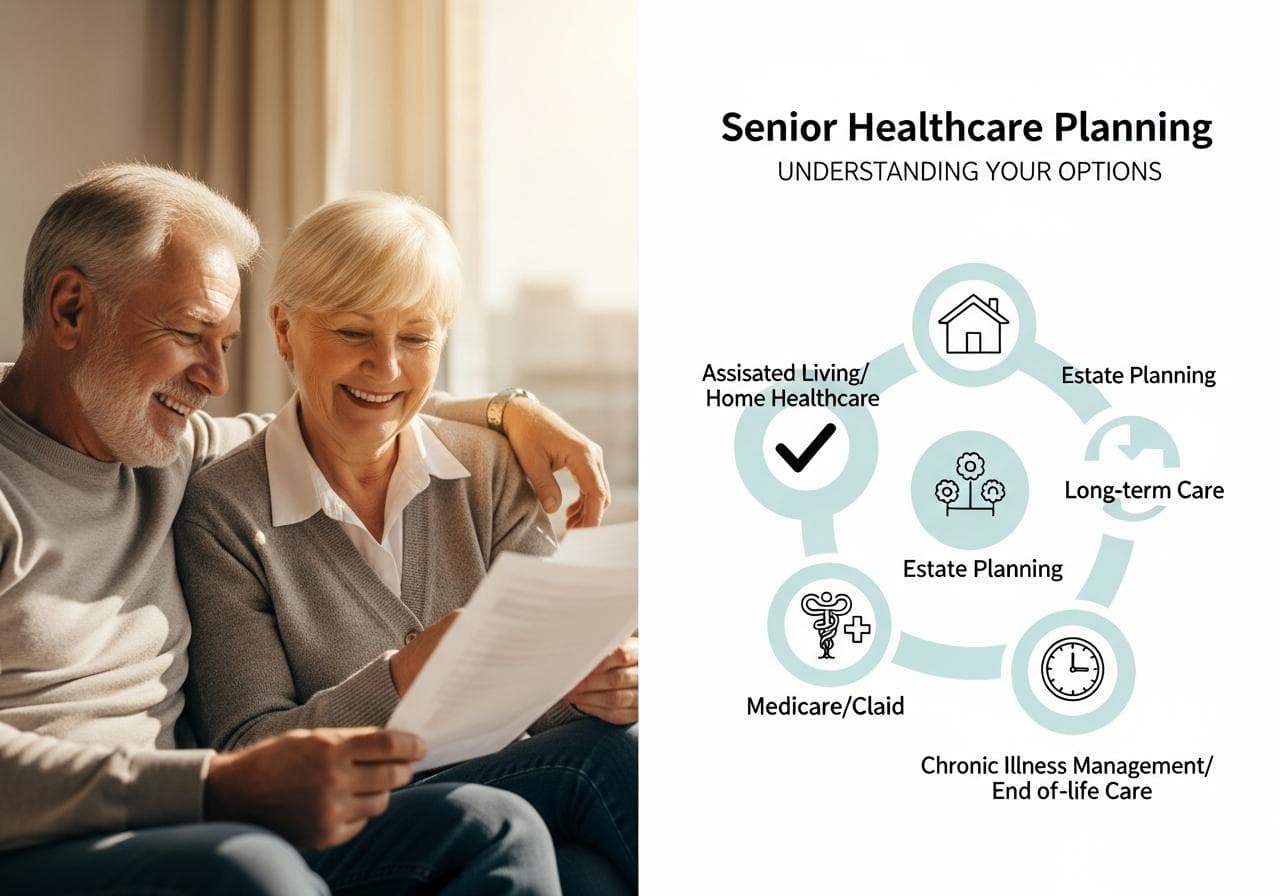

Senior Healthcare Planning & Estate Planning for Seniors

No discussion about Medicare and Medicaid would be complete without touching on Senior Healthcare Planning and Estate Planning for Seniors. Establishing a comprehensive plan that considers healthcare, living arrangements, and eventual end-of-life care is essential. Make sure to involve family members in conversations about your wishes to avoid complications later.

Understanding Special Needs Trusts

If you or someone you love has special needs, creating a Special Needs Trust can safeguard their eligibility for Medicaid and Supplemental Security Income without sacrificing vital assets. This can be invaluable when planning for care and ensuring that they have access to medical services without losing out on necessary Medicaid benefits.

Veterans Aid and Attendance

For veterans, the Veterans Aid and Attendance benefit can make a significant difference. This program provides a monthly pension to veterans and surviving spouses who are eligible, easing the financial burden of long-term care expenses. It’s a great idea to explore this option if you are or were part of the armed services.

Chronic Illness Management

Living with chronic illnesses can complicate healthcare needs significantly. Strong chronic illness management is essential to ensure quality of life and maintaining independence. Strategies can include medication management, regular check-ups, and home healthcare services designed to assist with daily tasks and medical needs.

End-of-life Care: Preparing for the Inevitable

Lastly, end-of-life care planning is an important component of your overall healthcare plan. Talk to your healthcare provider about options like palliative care and hospice services. Ensure you have your advance care directives in place to guide your loved ones when difficult decisions need to be made. You can learn more about advance care planning here.

Home Healthcare Services: The Best Mix for You

In conclusion, Home Healthcare Services can bridge the gap between independent living and more intensive forms of care. These tailored services make it easier to stay in your own home yet receive the necessary attention for health issues. They are often covered by Medicare and Medicaid, so they might just be the best option for your situation.

Making informed decisions about your healthcare can save you money and improve your overall quality of life. For more details on senior healthcare options, see the Colorado Division of Insurance site here or visit the Massachusetts government site here. The time to plan is now—because when it comes to health, every little bit helps.

Posts Relacionados

55 Plus Senior Communities The Pros And Cons

These communities offer active lifestyles but may have restrictions and higher costs for those seeking senior living.

55 Plus Senior Living Communities

These communities provide tailored housing, amenities, and social opportunities for individuals aged fifty-five and older.

Active Adult Community Guide

Discover fulfilling retirement living. Explore community options, amenities, and lifestyle choices designed for active adults seeking connection and well-being.